BankCD.com

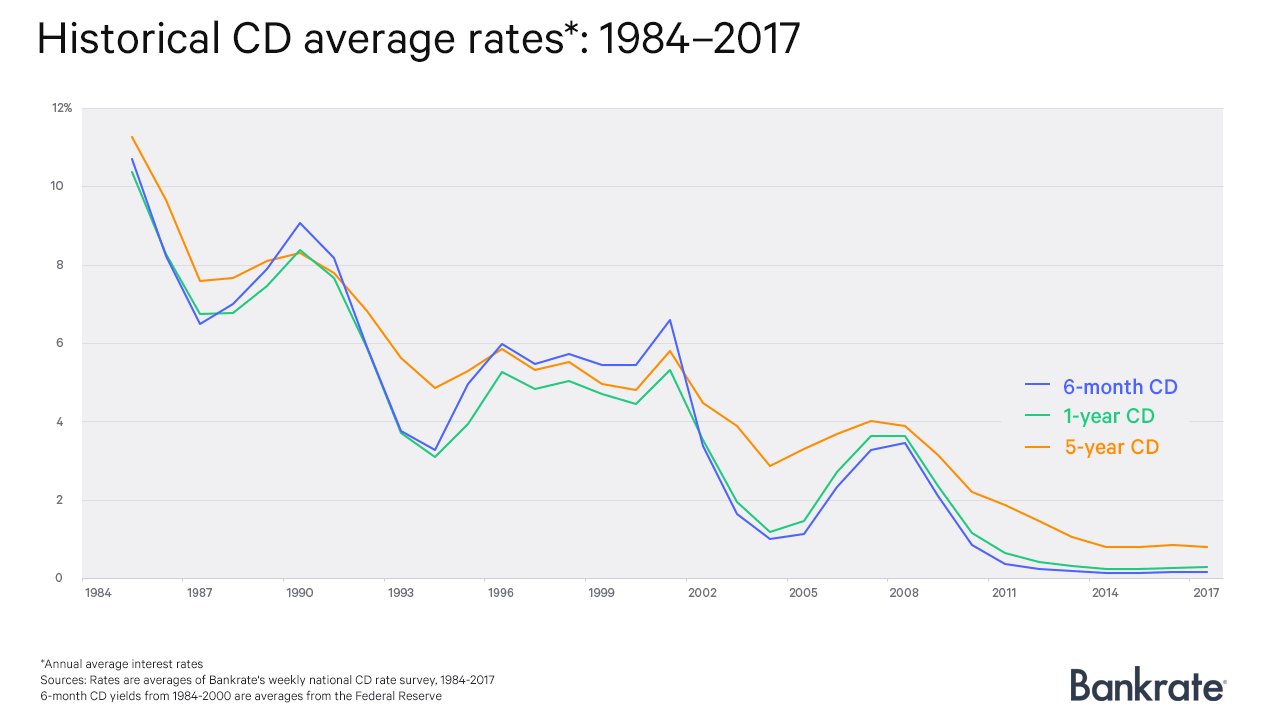

What are today’s CD rates? According to Bankrate’s most recent national survey of banks and thrifts, the average rate for a 1-year CD is 0.20 percent. The average rate for a 5-year CD is 0.33. Bankrate.com and similar websites have changed the way we shop for certificates of deposit (CDs) and other banking products by letting us compare annual percentage yields (APYs) from a number of banks in a matter of seconds. There's no denying the convenience and ease of these helpful online tools. Bankrate CD rates are a great place to start. But be aware that the information you get on these.

Certificates of Deposit Government-insured. Nationwide deposits by mail, phone, online or at a branch if nearby. More Nationawide CD Rates Months (mo)

|

Contact us if you found any problems/errors, have advertising inquiries, or wish to publish your institution’s rates. © 1994-2021 BankCD.com. All rights reserved. Privacy statement.

Named America's best big bank for the fourth year in a row, Capital One offers highly rated checking accounts, savings accounts and CDs. It offers customers free access to thousands of ATMs and a top-notch digital experience.

Highly rated accounts: Capital One offers a range of accounts that pay competitive yields. They also don’t charge monthly fees or require a minimum deposit to open, making them accessible to a range of savers.

Free ATM access: Customers have free access to more than 40,000 Capital One and Allpoint ATMs.

Top-notch digital experience: Capital One’s mobile app receives outstanding ratings from its users. It even launched a skill for Amazon's Alexa that lets customers find out information such as their bank account balance.

© Provided by Bankrate

Ally Bank has it all: top-tier yields on its deposit products, a free checking account that earns interest and a mobile app that stands out from the competition. It also offers free access to thousands of ATMs and reimbursements for fees charged at out-of-network ATMs.

Top-tier yields: Ally Bank offers top yields on its savings account, money market account and CDs. While some banks occasionally offer a top rate on their accounts, Ally consistently is among the best.

Bankrate Cd Rates Kansas City Area

Free checking and ATMs: Ally offers a free checking account, so you won’t have to worry about monthly fees and you can even earn a little bit of interest. Customers also have free access to thousands of ATMs, and Ally will reimburse up to $10 each statement cycle for fees charged at out-of-network ATMs.

Mobile app and features: Ally’s mobile app receives strong ratings from users. Customers who download the app have access to a voice-enabled assistant and debit card controls, in addition to other features such as remote check deposit, buckets for savings goals and even an Amazon Alexa integration.

© Provided by BankrateRidgewood Savings Bank is the largest mutual savings bank in New York State and operates 35 branches in the New York City metropolitan area. The bank offers a variety of deposit products, including checking and savings accounts, CDs, a money market account, and even a Vacation and Holiday Club Account. It stands out for its competitive rates, digital banking tools and massive ATM network.

Strong APYs: Ridgewood offers competitive rates across the board on its deposit products, but its savings account truly stands out with a top-tier yield.

Digital features: The bank offers a range of powerful digital banking tools, such as Alexa Voice Banking and Money Management for budgeting.

ATM access: Customers have access to a network of 55,000 surcharge-free ATMs worldwide in the Allpoint network.

© Provided by BankrateChicago-based Alliant Credit Union ranks as the best credit union for the third straight year. Alliant accounts offer competitive yields on a consistent basis. It offers a free checking account that earns interest, and customers have free access to thousands of ATMs. Additionally, Alliant has flexible membership requirements that make it so anyone can join.

Top savings account: All of Alliant’s deposit products pay very competitive yields to help savers reach their goals.

Free checking and ATMs: Alliant customers have free access to thousands of ATMs, and the credit union offers rebates of up to $20 per month for out-of-network ATM use.

12 Month Cd Rates

Flexible membership requirements: If you don't meet specific criteria listed on its website, you can become a member of Foster Care to Success (FC2S) to become eligible for Alliant membership. Alliant will pay a $5 membership fee to FC2S on your behalf.

Survey: Americans stick with their primary checking account for years

Americans tend to stay with the same financial institution over time, according to a new Bankrate survey of 2,339 adults with a checking account. Additionally, respondents whose household income has been negatively impacted by the COVID-19 pandemic are paying more than four times more per month in fees than those who say their household income has not taken a hit.

The average account holder has been with the same bank or credit union for 14 years, the survey found. The survey also found that respondents that have been hurt financially by the coronavirus pandemic are paying more in monthly fees than those who say their income hasn't been impacted. For those in households that have suffered a setback in income during the pandemic, the monthly average for checking account costs is over $11. Conversely, those who say their household income has not been negatively impacted by the pandemic report paying an average of less than $3 per month.

'Those whose personal finances have been adversely affected by the pandemic have been hit with a double whammy of higher banking fees,' says Mark Hamrick, Bankrate senior economic analyst. 'Unemployment or loss of income can be devastating, but one should try to avoid adding financial insult to injury by paying too much in banking fees when so many less expensive options abound.'

Be sure to shop around and compare financial institutions to ensure you're getting access to competitive products and helpful features, and also not wasting money on fees. Among the banks and credit unions highlighted here, you can find institutions offering free checking, high-yield deposit products, free ATM access and much more.

Bankrate Cd Rates Ohio

Methodology for Bankrate’s best banks and credit unions of 2021

Bankrate gathered checking account, savings account, money market account and CD data from dozens of brick-and-mortar banks, credit unions and online financial institutions. In doing so, we examined thousands of data points, looking at the fees each institution charges and the deposit rates it offers. Big banks generally had more than 500 branches across multiple states and regions. Regional banks generally had fewer than 500 branches located in one state or region. Online banks were those without branches or operating as digital financial institutions whose products are widely available online. Credit unions were membership-based organizations regulated by the National Credit Union Administration. The editorial team used its judgment in cases where there wasn't a clear delineation between categories. The research team gathered data from Sept. 11-Oct. 14, 2020, and then gathered APY data a second time from Dec. 7-10, 2020.

We chose one checking account, savings account, money market account and CD from each institution. If an institution didn't offer a given product, it was not scored. However, our methodology did account for the number of products available in the final rating. When an institution offered more than one checking account, we chose the one that offered free checking or the fewest barriers to avoid a monthly fee. In cases where an institution offered multiple free checking accounts, we chose the one that paid the highest APY. If it offered more than one savings account and/or money market account, we chose the one that offered the highest APY at the lowest monthly fee, with a minimum deposit of $25,000 or less. We chose the institution's best CD offer that had a term length between seven and 17 months, when the minimum deposit was $25,000 or less.

We assigned a score to each product category, looking at criteria including fees, APYs, minimum deposit requirements, minimum balance requirements, available CD terms, ATM access, mobile features and more. After scoring each product, we divided the total score by the number of products offered to reach the bank's final score. Each product was given a different weighting in the methodology. In the event of a tie, the financial institution with the higher APY on its savings account at the time of Bankrate's latest round of APY data collection (Dec. 7-10, 2020) received the higher ranking.

Jumbo Cd Rates

To determine the Readers' Choice winners, Bankrate issued a survey via SurveyMonkey for our audience to vote for their favorite financial institutions. Voters could choose from the same banks and credit unions Bankrate reviewed. Voting took place from Dec. 1-31, 2020.